Direction | Control | Choice

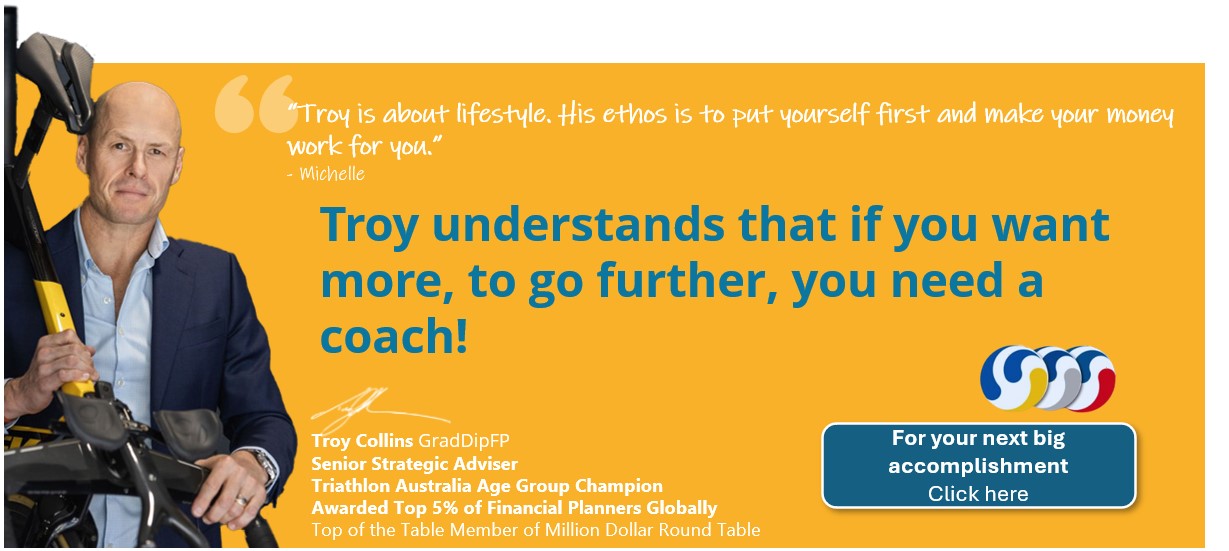

We help you define a clear DIRECTION with your finances to re-gain CONTROL of your life to achieve meaningful lifestyle CHOICES.

"We couldn't be happier with the outcome and the plan that is in place for our future and our children."

"Thanks to their expertise, we have a budget for regular family holidays and I even got my own budget for my triathlon pursuits!"

Partners

Collins Financial Group Pty Ltd (ABN 52 101 436 202) is a Corporate Authorised Representative of Matrix Planning Solutions Limited AFSL No. 238256 ACL No. 238256 ABN 45 087 470 200.